A PICTURE IS WORTH A THOUSAND WORDS

Precision Management Accounting prides itself with being able to explain complex accounting concepts and financial information simply.

Infographics have been designed to help explain how management accounting and accounting systems can assist organisations with day-to-day operations to guide them to reach their profit potential.

August 2017

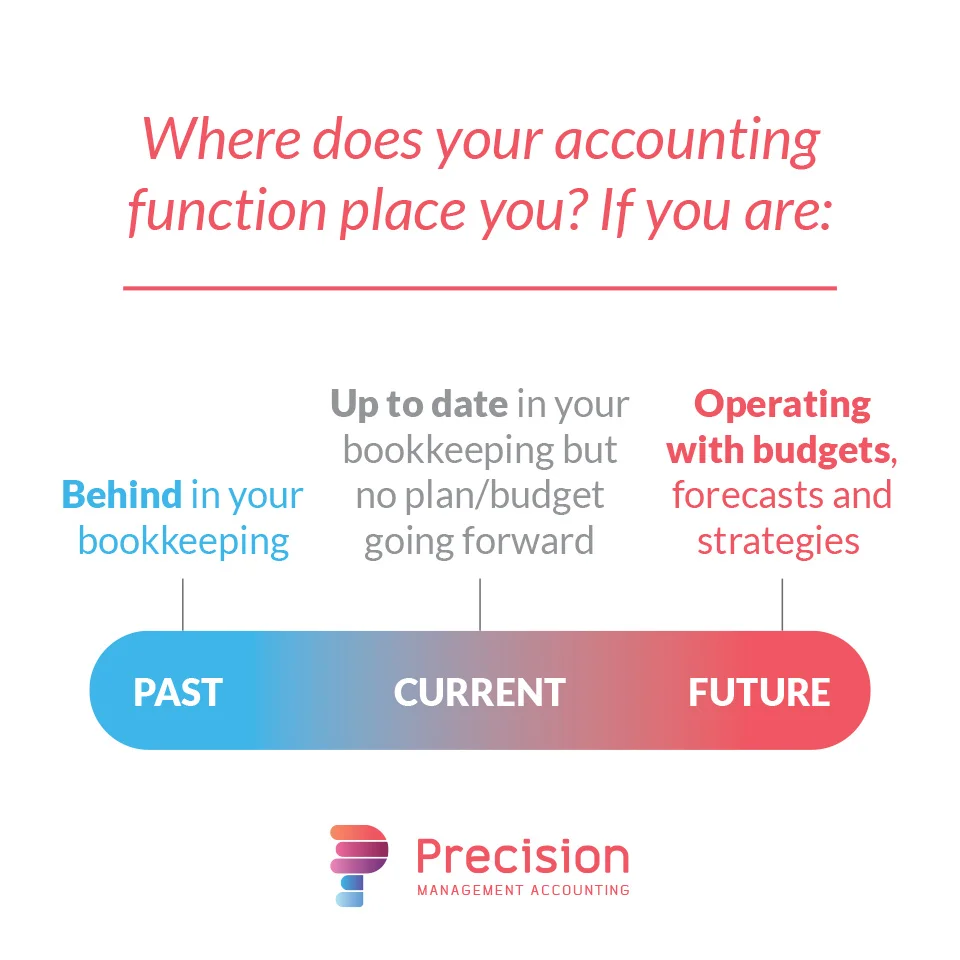

Finance Departments tend to spend most of their time and resources producing historical financial information t analyse how they performed in the PAST.

We believe that planning for your future financial performance is critical. It's important to have a strategy that considers the financial impact on key business decisions, such as how to fund future capital investment, or manage planned staff wage increases etc.

Having the ability to project your revenue, profit and cashflow into the future is powerful information to help management make informed business decisisons.

March 2017

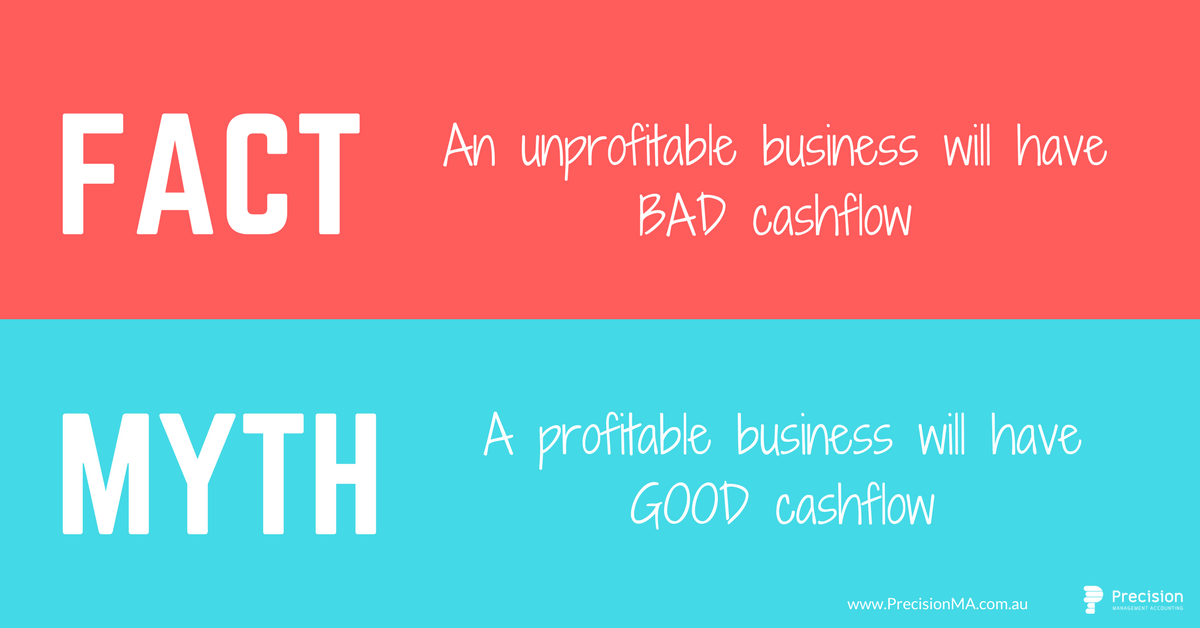

Too many business's focus on their bottom line - and often how to decrease profit to minimise paying tax!

The most important financial aspect of any organisation is CASHFLOW and this is very different from managing a profit and loss report.

August 4, 2016

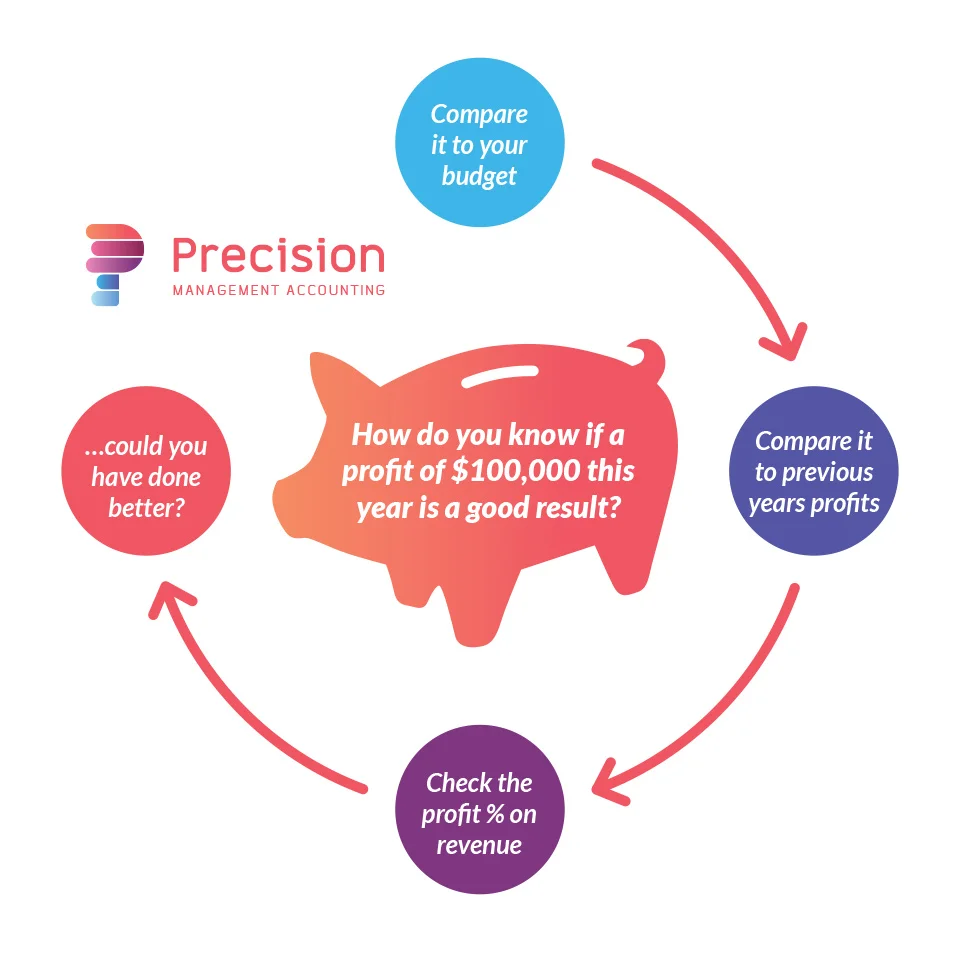

We are one month into the new financial year, but have you analysed how you performed last year?

Was your profit or surplus what you expected?

Did you achieve a good result?

Numbers are just numbers until they can be compared to something. It is important to develop a budget that formally documents your profit potential and business goals. Throughout the year, you can then track your actual performance against your budget and know if you are achieving a good result.

May 19, 2016

Numbers are just numbers until they are explained in context using language that the end user can understand. At Precision, we remove the accounting "mumbo jumbo" to ensure you understand your financial position and can effectively manage your business performance.

APRIL 11, 2016

Many small businesses try to save money by using spreadsheets to track revenue and expenses, or choose to update their financial systems only on a quarterly or annual basis at tax time.

Investing in a robust financial system (such as MYOB or Xero) is a standard business cost that can be used to help business owners manage their operations by generating meaningful financial reports and maintaining accurate information required by law for tax purposes.

MARCH 12, 2016

Bookkeeping tasks such as raising sales invoices, entering creditor purchases and reconciling the bank account, are often pushed aside to favour other work tasks or left to the last minute until it's BAS time. The downside of being behind in your bookkeeping is that you cannot review accurate financial information to assess how your business is performing.

Business owners want to know how their business is performing on a daily or weekly basis, so don't delay the bookkeeping tasks for weeks after month end.

Use technology and functions within your chosen systems to automate bookkeeping tasks to ensure that there is no delay with producing valuable financial information.

JANUARY 11, 2016

It's easy for a small to medium sized corporate business to focus on revenue, and we often hear small business owners say "we've had a great year, we're turning over close to $1m!". Our next question for these business owners is to ask how much of that revenue was left over for profit, and unfortunately not many people have been able to give us the answer. Creating steady revenue streams is critical for business success, but if your business is not generating profits from that revenue then this can highlight potential problems with business operations and financial viability.